The price/earnings (often shortened to the P/E ratio or the PER) is the ratio of a company’s stock price to the company’s earnings per share. The ratio is used in valuing companies. wikipedia

Companies with higher valuation, where investors are ready to pay today high today( high stock price), but earnings are not high today but investor believe that this company has potential to make earnings in future. So higher stock price, but lesser earnings now so PER is high.

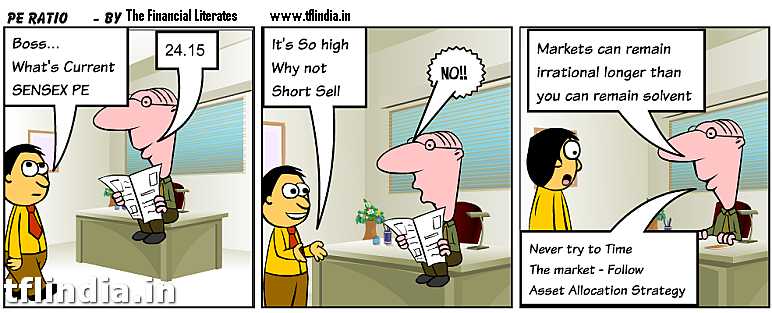

Or it might be investors expect higher return of the company so they have purchased the stock at high prices which led to increase in PER, or sometimes it can also mean that price of stock is inflated. Sometimes markets are just inflated for large period of time too.

So high P/E or PER ratio just says about market sentiments about the company. Today’s P/E of 25 might be P/E of 15 is some years down the line as company has achieved growth(has made enough earning to compensate the price of stock).

So high P/E or PER ratio just says about market sentiments about the company. Today’s P/E of 25 might be P/E of 15 is some years down the line as company has achieved growth(has made enough earning to compensate the price of stock).

High P/E stocks are also called Growth Stocks, and low P/E ratio are called Value stocks.

Reference :

- Image source: http://www.tflguide.com/2010/11/sensex-pe-ratio.html